Meal vouchers aren’t just popular, they’re also financially smarter than a salary increase. But what’s the exact difference in cost and net benefit? In this article, we compare both options and show why meal vouchers are the clear winner, for employers and employees alike.

1. Why meal vouchers are so attractive

Meal vouchers remain one of the most popular extralegal benefits in Belgium. Not without reason: the legal framework is particularly advantageous for both employer and employee.

- Employers are 100% exempt from social security contributions, and €2 per meal voucher is tax-deductible (and €4 normally as from January 2026 if €10).

- Employees are also 100% exempt from social contributions, resulting in maximum purchasing power.

Did you know?

85% of Belgian employers recommend meal vouchers, and 60% of employees see them as an essential part of their compensation package.

2. A concrete example: what do meal vouchers really cost?

Let’s take the case of an employer granting meal vouchers worth €8 per working day.

- Total value: €8 x 20 days = €160/month of meal vouchers

- Employee contribution: €1.09/voucher x 20 days= €21.80

- Net purchasing power for the employee: €138.2 net purchasing power

- Tax-deductible for the employer: €2/voucher x 20 days = €40

- Corporate tax: maximal 25% op €98.20 (€138.20 – €40) = €24.55*

- Total cost for the employer: €138.2 + €24.55* = €162.75

👉 You pay €162.75 to give your employee €138.20 in additional net purchasing power every month.

*This calculation is an average estimate.

Your key takeaways:

- What do your employees gain in extra net purchasing power? €138,2

- What does it cost you to grant meal vouchers to your employees? €162,75*

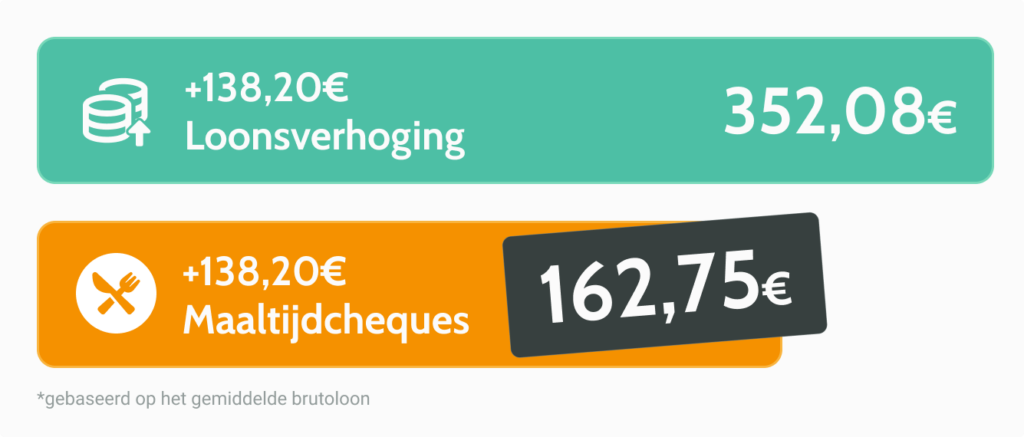

3. The difference with a salary increase

For the same net benefit of €138.20 per month, the calculation looks completely different. A salary increase involves both employer and employee social charges. In the end, you’ll pay around 50% more to give your employee the same net benefit as with meal vouchers.

A concrete example

Let’s calculate this for an average salary in Belgium, which is around €3,000 gross in 2024. If you want to give a net increase of €138.20 (the same as with meal vouchers) to an office worker without children, the calculation looks like this:

- Extra net salary: €138.20

- + Employee social contribution (13.07%*): €18.07

- + Income tax (36.97%*): €120.35

- + Employer contribution (27.28%*): €75.46

- Total cost for the employer = €352.08

*This calculation is a guideline based on the average gross salary.

The answers to your questions

- What do your employees gain in extra net purchasing power? €138.2

- What does it cost you to give a salary increase to your employees? €352.08*

4. Summary: salary increase vs. meal vouchers at a glance

Based on our example, which is calculated using the average Belgian gross salary for an office employee without children, you get the following conclusion.

👉If you want to grant a salary increase of €138.20 net per month, it will cost you €352.08. Offering meal vouchers worth €138.20 per month will cost you only €162.75. This is twice as cost-effective!

5. Why employers choose Monizze?

At Monizze, we combine the best value for money with digital innovation and personal service.

✅ Market leader in user-friendly tools

✅ We answer within 3 ringtones, no menu or waiting music

✅ Switching to Monizze is free and smooth

6. Meal vouchers: a strength for your employer branding

Not only financially attractive, but also strategically smart.

65% of young employees say they won’t apply to a company that doesn’t include meal vouchers in its salary package.

👉 With meal vouchers, you strengthen your attractiveness, satisfaction and retention.

7. Ready to take the next step?

With Monizze, it’s simple: we take care of everything for you.

Your employees gain purchasing power, and you reduce your costs, without any administrative burden.

Switch to Monizze today and discover how advantageous smart compensation can be.

In summary:

- Meal vouchers are socially exempt

- You pay about half the cost of a comparable salary increase

- Employees enjoy up to €138.20 extra net per month

- As of 2026, the maximum value increases to €10/day

- Monizze offers meaningful innovation, the best customer service and the easiest transfer