Certain joint committees are obligated to grant the purchasing power premium. They must order it before the 31st of December 2023. As a partner, we want to support you in this process. Check this page for the latest updates!

100 – Supplementary Joint Committee for Workers

min. € 125

Companies with a “high profit” must give €125 if the ratio of operating company profit (code 9901) to balance sheet total in 2022 is at least 1.25x the average for that same ratio over the years 2019-2021. Companies should give €250 if the ratio of operating operating profit (code 9901) to balance sheet total in 2022 is at least 1.50x the average for the same ratio over the years 2019-2021. Companies with “very high profits” must give a minimum of €375 in purchasing power premium. The purchasing power premium must be granted no later than 31 December 2023. To know what is meant by “high and very high profits”, consult the protocol agreement here.

102.06 – Gravel and sand quarries (workers)

min. € 500

Companies with “high profits” must grant minimum €500 in purchasing power premium. Companies with “very high profits” must grant minimum €750 in purchasing power premium. The purchasing power premium must be granted no later than the 30 december 2023. To know what is meant by “high and very high profits”, consult the protocol agreement here.

102.09 – Concrete (workers)

min. € 500

Companies with “high profits” must grant minimum €500 in purchasing power premium. Companies with “very high profits” must grant minimum €501 in purchasing power premium. The purchasing power premium must be granted no later than the 15 september 2023. In companies with a union delegation, this deadline may conventionally be set at a later date, but no later than Dec. 31, 2023. To know what is meant by “high and very high profits”, consult the protocol agreement here.

105 – Non-ferrous metals (workers)

min. € 250

The amount of the purchasing power premium is determined by the result of the comparison between the operating operating profit (code 9901) of the financial statements closed in 2022 and the average of the operating profit (code 9901) for the years 2019-2020-2021. Consult the protocol agreement here. Depending on the result of this comparison, the following purchasing power premium will be granted:

– Smaller than 5% : €250

– From 5% and smaller than 10%: €300

– From 10% and smaller than 20%: €500

– From 20% and smaller than 30%: €600

– Equal to or greater than 30%: €750

106.02 – Concrete industry (workers)

min. € 250

For those companies that by 2022 achieved high profits, the purchasing power premium:

– €250 if the profit in 2022 is at least equal to the average profit in the 3 previous closed financial years x 1.15;

– €500 if the profit in 2022 is at least equal to the average profit in the 3 previous closed financial years x 1.25.

For the companies that in 2022 achieved an exceptionally high profits, the purchasing power premium shall be €750. Consult the protocol agreement here.

109 – Clothing company (workers)

min. € 200

Companies with “high profits” must grant minimum €200 in purchasing power premium. Companies with “very high profits” must grant minimum €300 in purchasing power premium. The purchasing power premium must be granted no later than the 31 December 2023. To know what is meant by “high and very high profits”, consult the protocol agreement here.

111 – Metal, machine and electrical construction (workers)

min. € 200

Companies with “high profits” must grant a purchasing power premium of:

– €200 if the operating profit in the annual accounts for the 2022 financial year is less than, or less than 15% higher than, the average operating profit

– €350 if the operating profit in the annual accounts for the 2022 financial year is at least 15% higher than the average operating profit

– €500 if the operating profit in the annual accounts for the 2022 financial year is at least 25% higher than the average operating profit.

If the company has achieved very high profits in the 2022 financial year, the Purchasing Power Bonus amounts to €750. To find out what is meant by “high and very high profits”, consult the protocol agreement here.

112 – Garage (workers)

min. € 200

Companies with high profits with a 10% increase must allocate a minimum of €200 in purchasing power premium, with a 25% increase a minimum of €250 , with a 25% increase a minimum of €400 and with a 50% increase companies may have to calculate up to 15% of profits compulsorily. Consult the protocol agreement here.

116 – Chemical industry (workers)

min. € 350

Companies with “high profits” must grant minimum €350 in purchasing power premium. Companies with “very high profits” must grant minimum €351 in purchasing power premium. The purchasing power premium must be granted no later than the 30th of September 2023. To know what is meant by “high and very high profits”, consult the protocol agreement here.

118 – Food industry (workers)

min. € 250

Companies with “high profits” must grant minimum €250 in purchasing power premium. Companies with “very high profits” must grant minimum €251 in purchasing power premium. The purchasing power premium must be granted no later than the 31 December 2023. To know what is meant by “high and very high profits”, consult the protocol agreement here.

120.03 – Jute (workers)

min. € 100

Companies with “high profits” must grant minimum €100 in purchasing power premium. Companies with “very high profits” must grant minimum €150 in purchasing power premium. The purchasing power premium must be granted no later than the 31 December 2023. To know what is meant by “high and very high profits”, consult the protocol agreement here.

124 – Construction (workers)

min. € 250

Construction companies with 15% more profit than the 2019, 2020 and 2021 average must grant minimum €250 in purchasing power premium. Construction companies with profit growth of up to 25% compared to the average of the past 3 years must grant minimum €500 in purchasing power premium. Construction companies with profit growth from 50% compared to the average of the past 3 years must grant a €750 purchasing power premium. Check the collective labour agreement here.

127 – Fuel trade (workers)

min. € 200

Companies with “high profits” must give minimum €200 in purchasing power premium. Companies with “very high profits” must give minimum €350 in purchasing power premium. Companies with profits that are 6 times higher than the average profits of the years 2019/2020/2021 must give a maximum of €750 in purchasing power premium. The purchasing power premium must be granted no later than 31 December 2023. To know what is meant by “high and very high profits” consult the protocol agreement here.

128 – Skin and leather business and substitute products (workers)

min. € 50

Companies are split by number of employees:

1 – 49 employees: companies with a “high profit” must give minimum €50 in purchasing power premium. Companies with “very high profits” must give minimum €51 in purchasing power premium.

50- 99 employees: companies with “high profits” must grant minimum €75 in purchasing power premium. Companies with “very high profits” must give minimum €76 in purchasing power premium.

100+ employees: companies with “high profits” must grant minimum €100 in purchasing power premium. Companies with “very high profits” must give minimum €101 in purchasing power premium.

The purchasing power premium must be granted no later than 31 December 2023. To know what is meant by “high and very high profits”, consult the protocol agreement here.

130 – Printing, graphic arts and newspapers

min. € 125

Companies with “high profits” must give minimum €125 in purchasing power premium. Companies with “very high profits” must give minimum €225 in purchasing power premium. The purchasing power premium must be granted no later than 31 December 2023. To know what is meant by “high and very high profits”, consult the protocol agreement here.

136 – Paper and cardboard (workers)

min. € 250

A purchasing power premium of minimum €250 must be granted before the 15th of December 2023 to manual workers employed in a company that realised an operating profit (code 9901) in the year 2022.

139 – Inland navigation (workers)

min. € 500

Companies with “high profits” must grant minimum €500 in purchasing power premium. Companies with “very high profits” must grant minimum €750 in purchasing power premium. The purchasing power premium must be granted no later than the 31 December 2023. To know what is meant by “high and very high profits”, consult the protocol agreement here.

140.03 – Road transport and logistics (workers)

min. € 200

Companies with “high profits” must give a minimum of €200 in purchasing power premium. Companies with “very high profits” must give €350 in purchasing power premium if the 9905 that is positive is > 1.5 times the average code 9905 for the years 2019/2020/2021. Companies with “very high profits” must give €750 in purchasing power premium if the 9905 that is positive is > 6 times the average code 9905 for the years 2019/2020/2021. The purchasing power premium must be granted no later than 30 November 2023. To know what is meant by “high and very high gains”, consult the protocol agreement here.

140.04 – Ground handling at airports (workers)

min. € 200

Companies with profits above 6% must grant a purchasing power premium of €750. Companies with profits between 4% and 6% have to grant a purchasing power premium of minimum €600. Companies with profits between 2.01% and 4% have to grant a purchasing power premium of minimum €400. Companies with profits between 0.01% and 2% must grant a purchasing power premium of €200.

142.01 – Metal recovery (workers)

min. € 200

Companies with “high profits” must grant minimum €200 in purchasing power premium. Companies with “very high profits” must grant minimum €300 in purchasing power premium. The purchasing power premium must be granted no later than the 31 December 2023. To know what is meant by “high and very high profits”, consult the protocol agreement here.

142.02 – Rags recovery (workers)

min. € 200

Companies with “high profits” must grant minimum €200 in purchasing power premium. Companies with “very high profits” must grant minimum €300 in purchasing power premium. The purchasing power premium must be granted no later than the 31 December 2023. To know what is meant by “high and very high profits”, consult the protocol agreement here.

149.01 – Electricians: installation and distribution (workers)

min. € 250

For companies with high profits in 2022, the purchasing power premium is:

– €250 if the operating profit in 2022 has increased by a minimum of 15% compared to the average operating profit in 2019 to

through 2021;

– €500 if the operating profit in 2022 has increased by a minimum of 25% with respect to the average operating profit in 2019 to

through 2021.

For companies with exceptionally high profits in 2022, the purchasing power premium is: €750 if the operating profit in 2022 has increased by a minimum of 50 % compared to the average operating profit in 2019 to 2021.

To know what is meant by “high and very high profits”, consult the protocol agreement here.

149.02 – Bodywork (workers)

min. € 200

There is entitlement to €200, if the company’s profit in 2022 is 15% more than the average profit of the financial years 2017-2021. There is entitlement to €300, if the company’s profit in 2022 is 30% more than the average profit of the financial years 2017-2021. There is entitlement to €450, if the company’s profit in 2022 is 60% more than the average profit of the financial years 2017-2021. Consult the collective agreement here.

149.03 – Precious metals (workers)

min. € 125

Companies with profits between 25% and 50% higher than the average of 2019, 2020 and 2021 and whose operational profit is at least 5% of the total assets must grant minimum €125 in purchasing power premium. Companies with profit growth from 50% above the average of the past 3 years and whose operational profit is at least 5% of total assets must grant minimum €250 in purchasing power premium. Companies with a doubling of profit and whose operational profit is at least 5% of total assets must grant minimum €375 in purchasing power premium. Check the collective labour agreement here.

149.04 – Metal trade (workers)

min. € 250

Companies must give the following amounts according to profit:

– €250 in purchasing power premium when the operating operating profit in 2022 (code 9901) has increased by 15% compared to the average profit (code 9901) over the period 2017-2021.

– €375 in purchasing power premium when the operating operating profit in 2022 (code 9901) increased by 30% compared to the average profit (code 9901) over the period 2017-2021.

– €500 in purchasing power premium when the operating operating profit in 2022 (code 9901) has increased by 50% compared to the average profit (code 9901) over the period 2017-2021.

– €750 in purchasing power premium when the operating operating profit in 2022 (code 9901) increased by 75% compared to the average profit over the period 2017-2021.

Consult the collective bargaining agreement here.

200 – Employees

min. € 125

Companies whose ratio of operating profit (code 9901) to the total assets in 2022 is at least 1.25 times greater than the average of the same ratio for the three accounting years (2019, 2020, 2021), and whose operating profit represents at least 5% of total assets, must grant at least €125. Companies whose ratio of operating profit (code 9901) to the total assets in 2022 is at least 1.5 times greater than the average of the same ratio for the three accounting years (2019, 2020, 2021), and whose operating profit represents at least 5% of total assets, must grant at least €250. Companies whose ratio of operating profit (code 9901) to the total assets in 2022 is at least 2 times greater than the average of the same ratio for the three accounting years (2019, 2020, 2021), and whose operating profit represents at least 5% of total assets, must grant at least €375. Consult the protocol agreement here.

Thanks to our simulator for JC 200, find out whether you are obliged to grant the premium

201 – Independant retail

min. € 75

When company profits are positive in 2022 and have increased by 5% to less than 25% compared to the average of the years 2019-2021, employees in non-food companies, specialized food companies, and bakeries will receive a premium of €75. For supermarket employees, the premium is increased to €150. In the case of an increase of at least 25% in company profits in 2022 compared to the average of 2019-2021, employees in non-food companies, specialized food companies, and bakeries will receive a premium of €150. Supermarket employees will receive a premium of €250 in this case. Check the collective labour agreement here.

207 – Chemical industry (employees)

min. € 350

Companies with “high profits” must grant minimum €350 in purchasing power premium. Companies with “very high profits” must grant minimum €351 in purchasing power premium. The purchasing power premium must be granted no later than the 30th of September 2023. To know what is meant by “high and very high profits”, consult the protocol agreement here.

209 – Metals (employees)

min. € 200

Companies with “high profits” lower than 15% must grant minimum €200 in purchasing power premium. Companies with a “high profit” higher than 15% must grant minimum €350 in purchasing power premium. Companies with a “high profit” higher than 25% must grant minimum €500 in purchasing power premium. Companies with “very high profits” must grant minimum €750 in purchasing power premium. The purchasing power premium must be granted no later than 31 December 2023. To know what is meant by “high and very high profits” and further details, consult the protocol agreement here.

211 – Petroleum industry and trade (employees)

min. € 500

Companies with “high profits” must give a minimum of €500 in purchasing power premium. Companies with “very high profits,” if the profits are at least 20% higher than the average operating profit in the period 2019-2021, must give €750 in purchasing power premium. The purchasing power premium must be granted no later than December 30, 2023. To know what is meant by “high and very high profits” consult the protocol agreement here.

215 – Clothing company (employees)

min. € 200

Companies with “high profits” must grant minimum €200 in purchasing power premium. Companies with “very high profits” must grant minimum €300 in purchasing power premium. The purchasing power premium must be granted no later than the 31 December 2023. To know what is meant by “high and very high profits”, consult the protocol agreement here.

220 – Food industry (employees)

min. € 250

Companies with “high profits” must grant minimum €250 in purchasing power premium. Companies with “very high profits” must grant minimum €251 in purchasing power premium. The purchasing power premium must be granted no later than the 31 December 2023. To know what is meant by “high and very high profits”, consult the protocol agreement here.

222 – Paper and cardboard (employees)

min. € 250

A purchasing power premium of minimum €250 must be granted before the 15th of December 2023 to employees employed in a company that realised an operating profit (code 9901) in the year 2022.

224 – Ferrous metals (employees)

min. € 250

The amount of the purchasing power premium is determined by the result of the comparison between the operating operating profit (code 9901) of the financial statements closed in 2022 and the average of the operating profit (code 9901) for the years 2019-2020-2021. Consult the protocol agreement here. Depending on the result of this comparison, the following purchasing power premium will be granted:

– Smaller than 5% : € 250

– From 5% and smaller than 10%: € 300

– From 10% and less than 20%: € 500

– From 20% and smaller than 30%: € 600

– Equal to or greater than 30%: € 750

226 – International trade, transport and logistics (employees)

min. € 50

The amount of the purchasing power premium depends on the company’s profit growth in 2022. The mandatory amount fluctuates between €50 and €750 depending on the percentage growth of the company. The purchasing power premium must be granted before 31 December 2023. Explore the document here.

302 – Hotel industry (workers)

min. € 125

Companies with “high profits” between 2% and 3% must grant minimum €125 in purchasing power premium. Companies with a “high profit” between 3% and 10% must give minimum €200 in purchasing power premium. Companies with “very high profits” higher than 10% must grant minimum €375 in purchasing power premium. The purchasing power premium must be granted no later than 31 December 2023. To know what is meant by “high and very high profits” and further details consult the protocol agreement here.

313 – Pharmacies and pricing services (workers)

min. € 150

Companies with “high profits” must give minimum €150 in purchasing power premium. Companies with a “very high profit” must give minimum €175 in purchasing power premium. To know what is meant by “high and very high profit”, consult the protocol agreement here.

315.02 – Airlines (workers and employees)

min. € 250

The amount of the purchasing power premium is determined by the result of the comparison between the operating operating profit (code 9901) of the financial statements closed in 2022 and the average of the operating profit (code 9901) for the years 2019-2020-2021. Consult the protocol agreement here. Depending on the result of this comparison, the following purchasing power premium will be granted:

– Smaller than 5% : € 250

– From 5% and smaller than 10%: € 300

– From 10% and less than 20%: € 500

– From 20% and smaller than 30%: € 600

– Equal to or greater than 30%: € 750

320 – Funeral parlours (workers and employees)

min. € 125

Companies with “high profits” must grant a minimum purchasing power premium of €125. Companies with “very high profits” must grant a minimum purchasing power premium of €250. The purchasing power premium must be granted no later than 31 December 2023. To find out what is meant by “high profits and very high profits”, consult the agreement here.

323 – Building management, real estate brokers and servants ( workers and employees)

min. € 200

Companies with “high profits” must give minimum €200 in purchasing power premium. Companies with “very high profits” must grant minimum €400 in purchasing power premium. The purchasing power premium must be granted no later than Dec. 30, 2023. To know what is meant by “high and very high profits” consult the protocol agreement here.

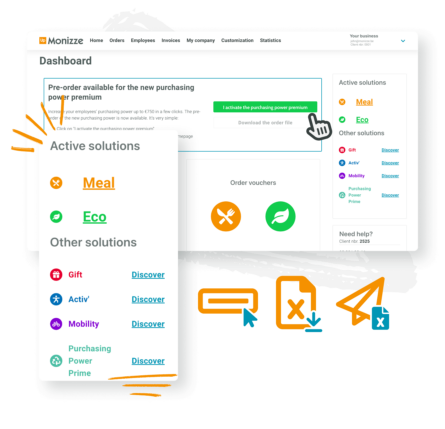

How do you order via the client area?

Ordering is very simple. Increase the purchasing power in a few clicks:

- Activate the premium via the banner on the homepage of the client area

- Confirm the activation by clicking “I activate the purchasing power premium”

- Select the purchasing power premium icon under “Order vouchers”

- Either manually enter the face value for each employee or import a file

Let Monizze contact your clients

Are you our partner and would like us to contact your clients? Send an e-mail to partner@monizze.be or call 02 891 88 00.

More and more social secretariats are opting for the payroll software ordering procedure. We’re working hard to make this procedure as simple and efficient as possible from the 1st of June.